Data challenges in insurance #

Insurance has always been a data-heavy industry. Some companies have client data going back more than a hundred years. Millions and millions of data points. But life insurers have not traditionally been at the forefront of the data-driven company revolution.

Today, a transformation is underway. Insurers are focusing on harnessing and leveraging their data for a wide variety of strategic uses.

—Brian Carey, Senior Director, Core Insurance Solutions, Equisoft

However, as life insurance organizations evolve into more data-driven businesses, they face significant challenges that impede their ability to convert all of their valuable data into true strategic assets.

To understand the nature of those data challenges in the insurance industry and how carriers are solving them, Equisoft commissioned Celent to conduct quantitative and qualitative research with North American life insurance CIOs.

One of the key findings in the research was that the two biggest data challenges CIOs are facing today are that: their company culture is not data driven; and the proliferation of vendors and systems, create hard to break down data silos.

1. The organizational data challenge

#

Most insurance companies are in the process of trying to transform themselves into data-driven businesses. Each company lies somewhere along a spectrum in terms of the maturity of their data-culture and the organizational structure that supports it.

—Mike Allee, President, Universal Conversion Technologies

Depending on size, complexity and the maturity of their data strategy, insurers take different approaches to how they organize their resources. Typically, smaller companies or those in the earlier stages of their data evolution will appoint one person as their data leader—usually a subject matter expert.

Although this person may have the most familiarity with the data, without strong technical discipline and approach to caring for / feeding the “data machine” they can also become a bottleneck of technical knowledge that slows progress toward this data-driven future. Sometimes they can create silos or delays because their focus is isolated rather than enterprise big picture. Proper strategic planning and tactical execution will contribute to better success around how data will be managed across the entire organization.

As data strategy and execution matures, there’s a natural evolution of leadership roles that support the data driven future. From SMEs to increasingly senior roles like VP Data Solutions, Chief Data Officer and eventually perhaps a data role of the company’s Board. The trend is towards broader-based, integrated planning for the whole of the business.

—Mike Allee, President, Universal Conversion Technologies

2. The legacy systems and siloed data challenge #

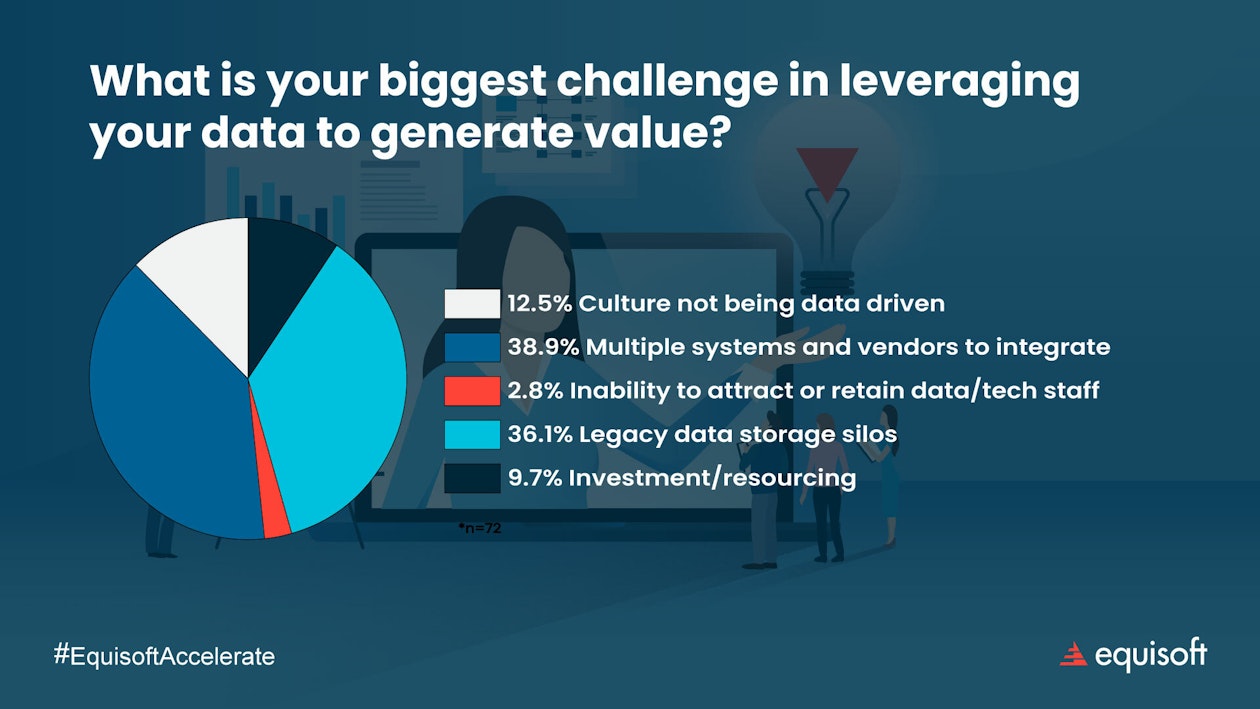

In our recent How North American Insurance Execs Are Leveraging Their Data Today webinar, we asked attendees:

Clearly, most attendees were concerned with having to integrate multiple systems and vendors and the impact of legacy data storage silos.

System, vendor and data proliferation #

As insurers grow, so does the complexity of their IT landscape. The interviews that were done as part of Equisoft & Celent’s Getting Value from Data: The Insurer’s Perspective research, revealed that CIOs are dealing with a variety of different systems, each built for a different purpose, perhaps related to a specific line of business or product.

These unique environments create ‘stove pipes’ containing data sets that are appropriate to the initial purpose the system was designed for, but not very adaptable to other uses. When software and processes are not standardized, carriers can end up with a ‘vendor stew’. Data is duplicated and then evolves as the organization conducts different pilot projects, proof of concepts (POC), and internal applications. Data often ends up lying dormant in spreadsheets and not really being captured or tracked in the proper ways.

As all these systems get out of sync because the data changes over time and the changes are not coordinated, understanding what is the source of truth or what is the core set of facts becomes an issue.

—Marty Ellingsworth, Research & Advisory - Data and Advanced Analytics, Celent

When data is distributed and not kept in sync across a variety of systems, then decision-making becomes difficult. Which source of data is the truest, most reliable and useful one?

Efforts to solve that problem require coordination of executives and resources across the organization. Processes must be put in place that enable decision-makers to identify the sets of source data they all agree are accurate. Getting to a point where all parties can trust the data is a critical element of developing a data-driven culture.

Legacy system data silos #

Aside from the proliferation of core systems and data sets, the biggest challenge for carriers is that they still have large volumes of data resident in legacy systems. For all intents and purposes this data is locked. Oftentimes, the information is in different data formats that you can't access. Or, the data may not even be granular enough to reconcile the particular metrics that you want to capture.

Take for example, regulatory changes like GDPR or IFRS-17/LDTI, which present significant data challenges. Not only does data need to be captured, but it has to be at the right level of granularity to be used in reporting. Or it may need to be redacted or deleted. All operations are difficult to manage on legacy platforms.

Wrap up #

As life insurers transform into more data-driven businesses, they will have to find the right cultural and organizational approach to managing their data and data projects. As part of that overarching approach to data, all parts of the organization will need to solve the twin problems of system proliferation and data silos.

Only when insurers have access to all their data, and an approach to working with it that permeates the entire company, will they realize the true potential of that vast strategic asset.

Watch the webcast to find out how life insurance CIOs are solving their data challenges.