The insurance industry is moving into a more streamlined, more digital stage‒one where paper statements, contracts that run to dozens of pages, ink and mail and fax and even phones have become relics. And yet all of those things are still embedded in a lot of our insurance workflows.

Like speedbumps. Waiting to disrupt customer experience.

When many critical processes include both digital and traditional steps, how can Caribbean insurers provide superior client engagement throughout the policy lifecycle?

The need to rethink our approach to insurance customer experience #

‒ Rendra Gopee, Managing Director, Cedros Capital Partners

The pandemic has certainly accelerated insurer’s efforts to enhance client experience by implementing digital sales and service tools. But the results are uneven because they often choose to cherry pick their modernization initiatives, focusing on one function or process at a time.

That approach may deliver incremental improvements in some client experiences, but probably won’t create an overall bump in engagement. For instance, implementing a more robust quote & illustration tool may improve a prospect’s experience during that step in the sales process. But that’s only one ‘moment of truth’ in the evolution of a client’s relationship with the company over the course of a policy life cycle.

What is needed is a more holistic strategy for engaging clients.

-Annalee Moore, Board Director, Equisoft

Customer engagement is an outcome of every single step in every interaction‒for good or bad #

The biggest long term advances in customer engagement come from taking an integrated approach that applies across the entirety of the customer value chain. Which means that insurers should be considering the quality of client experience in each step of every process, product and policy event. Over time, every interaction can be judged according to whether it meets the company’s benchmarks for CX and how much it contributes to getting closer to achieving the overall vision for client engagement.

That process is ongoing, effects every part of the enterprise and presents some significant challenges.

What is the biggest client engagement challenge you are facing right now? #

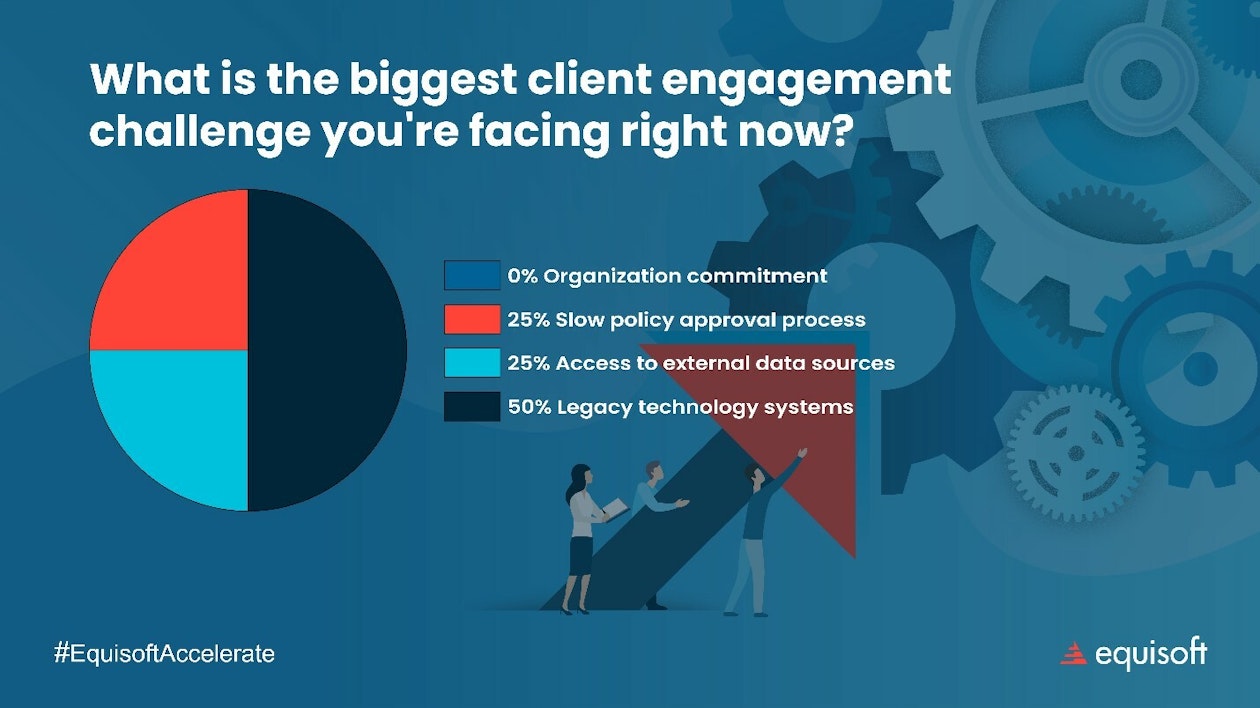

During Equisoft’s recent Driving Digital Client Engagement Through The Entire Caribbean Insurance Value Chain webinar, we asked attendees: What is the biggest client engagement challenge you’re facing right now?

Respondents to our poll cited legacy technology systems as the biggest impediment to creating superior client engagement challenge.

Legacy technology challenges have been exacerbated by the pandemic. And, in the Caribbean, there’s an added complexity because of the huge challenge of becoming compliant with the new IFRS 17 reporting standards. The ability to easily access and convert data for use across the organization is a keystone of achieving IFRS 17 compliance, but it’s very hard to do if you’re trying to work with old legacy policy administration systems (PAS) that tend to trap data in silos.

And from an end-to-end point of view, those legacy core systems tend to cripple efforts to implement the modern, digital sales and service solutions that are needed to create engagement with today’s consumers. PAS that can’t use APIs to deliver data where it’s needed in real time hinder efforts to speed on-boarding or provide efficiencies through sales and self-service portals.

The fact that older core systems require new code to be written for every product change or new product implementation puts a speed limit on innovation and makes enterprises less competitive than their peers who have modernized. The damage to customer experience and engagement is done when it becomes too difficult or takes too long for an insurer to develop new products that meet heightened consumer expectations.

To learn more about how to improve customer experience and engagement in the insurance industry, watch the Equisoft Accelerate Series webcast: Driving Digital Client Engagement Through The Entire Caribbean Insurance Value Chain.