Risk Free IFRS 17 Compliance With A Trusted Partner

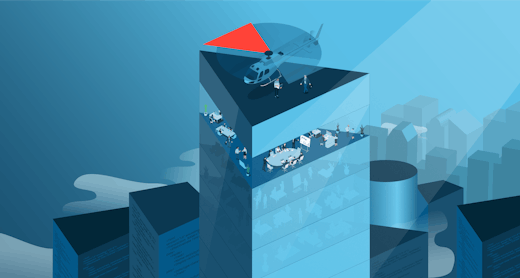

The biggest change to insurance compliance in 20+ years. As a trusted Oracle partner, we're best suited to help you with the demand of this new standard while adhering to best practices and interpretations.