Carriers and distributors have an opportunity to add value for their advisors by solving their client relationship management challenges. The Datos Insights (previously Aite-Novarica) Market Navigator CRM report is a comprehensive review of the market intended to help carriers choose the right solution.

What customer relationship management (CRM) challenges do insurance advisors face? #

Insurance agents run complex, highly specialized businesses. They typically have hundreds, if not thousands of client relationships to manage. Each client has unique needs, goals and may have purchased a number of different insurance and investment products.

Those relationships are governed by regulatory compliance needs. And each will have different service expectations. In many cases, the sales process can be multi-phased.

Managing all of the activity required to exceed client expectations, while staying compliant, and grow the business is a big ask. It can be difficult, if not impossible in some cases, to manage on an ad hoc basis. Pen and paper don’t cut it anymore. Even cobbled together workflows that take advantage of Outlook[GN1] , Excel spreadsheets and Word docs can’t keep up.

Many who run their agencies this way, worry about missing a meeting, forgetting a follow-up task or losing compliance documentation. Plus, client data from different carriers isn’t centralized in one location.

Why generic CRM solutions don’t meet insurance advisors’ specialized needs? #

Even when advisors implement a CRM solution to solve client management frustrations, the results may not be what they hoped for.

Successfully increasing efficiency and effectiveness is really dependent on the solution they implement. Trying to manage, let alone grow an insurance advisory practice is very difficult using popular generic CRM solutions on the market. Those tools weren’t designed with all of the ‘quirks’ of the insurance industry in mind. As Datos Insights (previously Aite-Novarica) noted in their recent Market Navigator report on CRM Systems for US Insurers:

To enable insurers to make the best choice when selecting a CRM, Datos Insights (previously Aite-Novarica) reviewed important CRM criteria, such as:

- details of the vendor organization

- technology stack

- client base

- key functionality

- key differentiators

- lines of business supported

- deployment options

- implementation approaches

- how upgrades/enhancements are handled

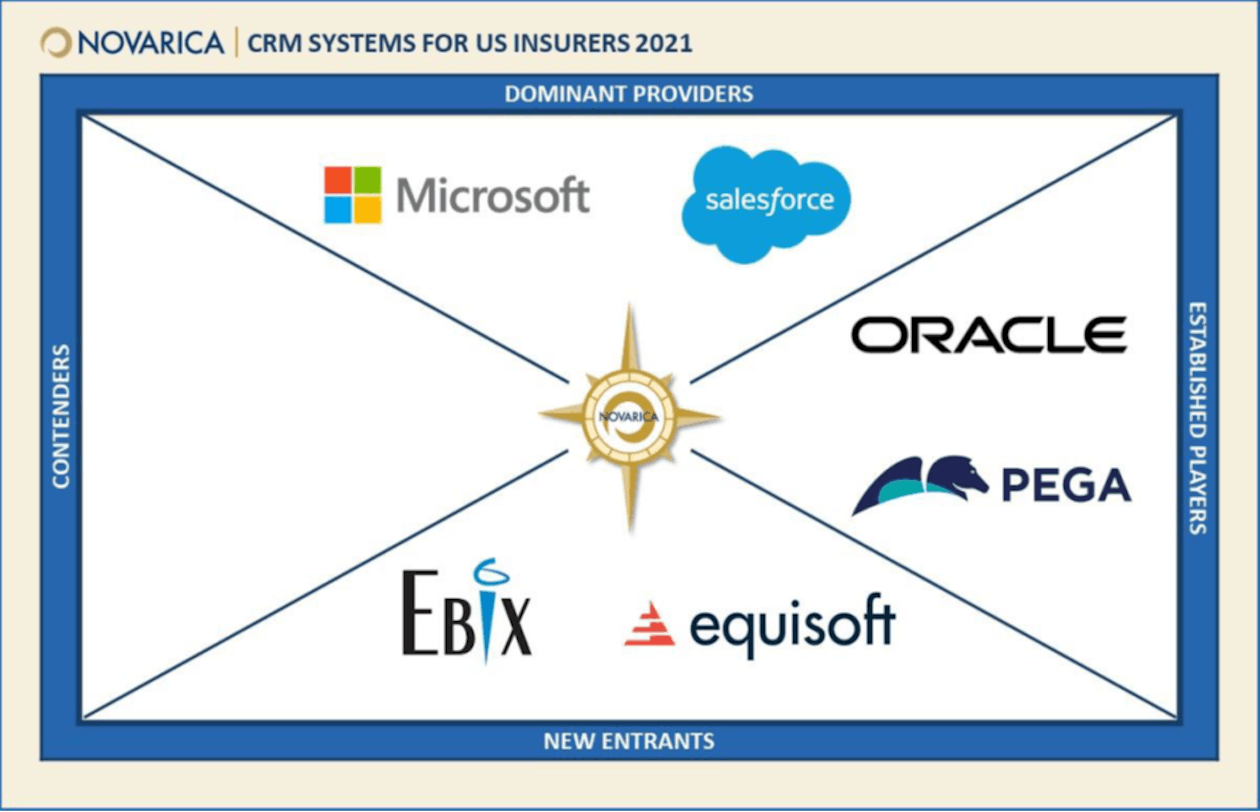

Which solutions did the Datos Insights (previously Aite-Novarica) Market Navigator CRM Systems for US Insurers report review? #

The report explored offerings from existing generic solutions, new entrants and companies that have recently upgraded their existing solutions. Although listed as a new entrant the original version of the Equisoft/connect CRM was developed more than 15 years ago and supports more than 20,000 insurance professionals in the management of their relationships and practices.

Equisoft/connect is an advisor-focused CRM with built-in data aggregation capabilities to improve business efficiency. It’s specifically designed to help advisors and enterprises spend less time maintaining data, and more time engaging customers.

—François Laporte, Financial Advisor and Broker Representative

--Datos Insights (previously Aite-Novarica) CRM Systems for US Insurers 2021