The Importance of Customer Experience in Insurance #

—Dan McCoach, Head of North America Insurance, Life & Health, Celent

How do insurers provide superior customer engagement? How do they provide the kind of service consumers have come to expect because of their everyday interactions with businesses ranging from online retail to streaming services to food delivery?

The solution requires more than just creating a singular awesome client experience. Rather, a real competitive edge is built when a carrier is able to create customer journeys in which every interaction with the organization, whether online or offline, builds confidence and trust.

What are the biggest client engagement challenges carriers face? #

As far as client engagement is concerned COVID has only helped to accelerate transformations that were already happening across our industry. But realizing the full business value of enhanced digital engagement can be difficult when carriers approach the challenge in traditional ways.

For too long, many carriers have tended to cherry pick modernization initiatives in isolated silos or functions. Picking this low-hanging fruit may result in incremental improvements in some client experiences, but probably won’t generate an overall increase in engagement. A better illustration tool may improve a prospect’s impression of that part of the sales process. But it’s only a small part of their overall relationship with the carrier over the course of a policy life cycle.

What is needed is a more holistic approach to engaging clients.

Customer experience in the insurance industry across the customer value chain #

Going forward, carriers need to consider engagement as part of every process, product and policy event. It’s important to be continually improving customer experience in the insurance industry. Having a great UI/UX has become table stakes. Many carriers have developed simplified products. Most have some form of self-service portal. But real advances in customer engagement come from taking a holistic approach and cutting horizontally across the entirety of the customer value chain.

Rather than implementing a series of un-related solutions, carriers need to rethink and reimagine how they are connecting with clients across the entire insurance landscape. What is the overall story that is being written by carriers and customers together? How does each element of each interaction contribute to the overall quality of the journey?

A critical generational shift drives the need for new engagement approaches #

Superior client engagement requires a deep understanding of your different audiences and how their needs are evolving. Almost all customers, and especially the younger generations, have different expectations around technology, relationship and speed of satisfaction. Consider how those heightened needs for greater personalization, real-time decision making, and multi-channel access affect each step in the customer journey. Question every activity along the workflow and look for improvements.

Start by examining how you engage with potential clients before a sale is even made. How are your products marketed? How do you communicate the essentials about your services in a digestible way that people can act on?

—Kartik Sakthivel, Vice President & Chief Information Officer, LIMRA/LOMA

How can carriers make it easy for clients to get quotes, understand the details of what they’re looking to purchase and then easily apply?

And, how can insurers streamline critical processes like approvals and claims? It can’t take weeks for an approval decision to be made. Carriers need to develop ways to issue policies faster through automated, accelerated underwriting programs.

And how do we continue to engage with clients over the lifespan of a policy? How do their expectations affect everything from billing to service to claims?

—Kartik Sakthivel, Vice President & Chief Information Officer, LIMRA/LOMA

Each of those steps in the client journey is an opportunity to increase overall engagement and continue to build satisfaction, trust and relationship over time.

What hinders insurers ability to create great client engagement? #

— Ray Adamson, Vice President, Insurance Solutions, Equisoft

Data challenges #

One of the biggest hurdles insurers face is leveraging their data to enhance customer engagement. Our industry is built on a foundation of a tremendous amount of data. But it’s not always easy to access or leverage. In many cases, the data isn't as clean or as accurate as it could be. All of those data concerns make it hard to gain deep understanding of an individual customer’s needs. And, that makes delivering hyper-personalized service very difficult.

Legacy core systems challenges #

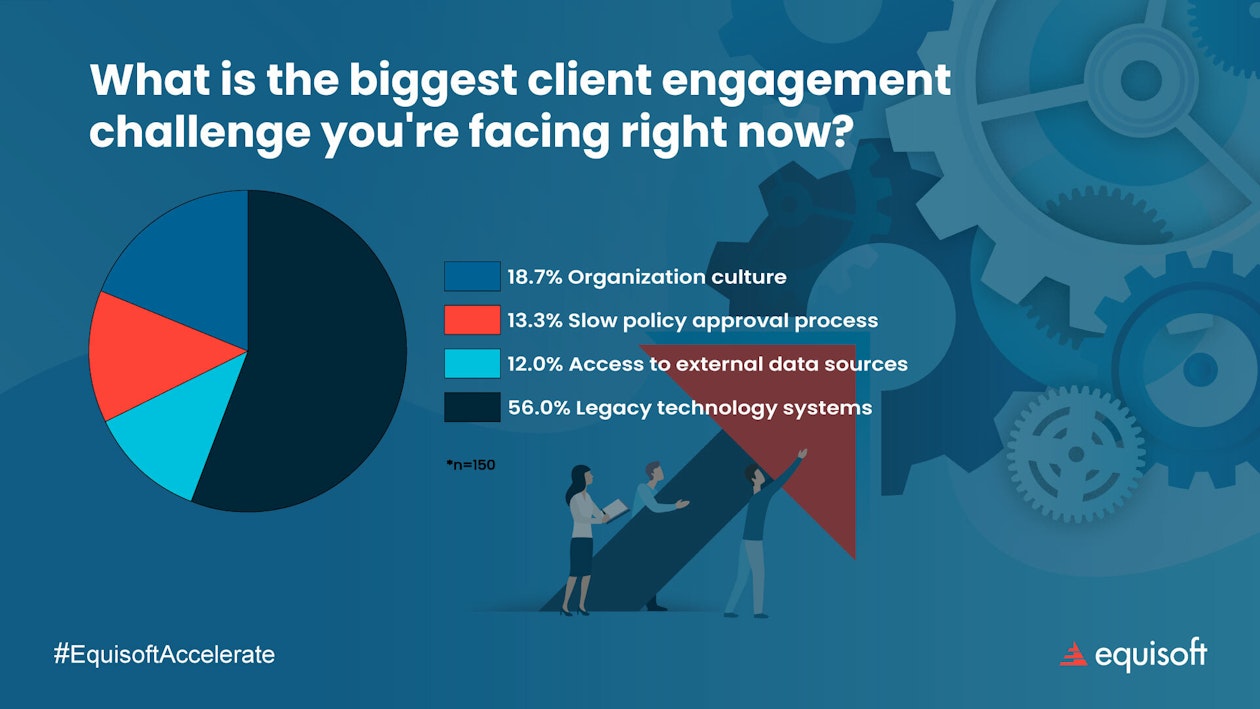

During Equisoft’s recent Driving Digital Client Engagement Through The Entire Insurance Value Chain webinar, we asked attendees: What is the biggest client engagement challenge you’re facing right now?

The restrictions imposed by legacy technology systems was by far the biggest impediment to enhancing client engagement. And the issue is difficult to resolve.

Choose the right modernization strategy #

Carriers are challenged to look ahead three to five years and decide what technologies the organization will need in order to fully engage with customers going forward. And they’ll also have to look back, because that strategy will need to consider how the carrier can overcome their accumulated technical debt and the drawbacks of their legacy systems.

Adapting or building on top of existing legacy technology improves an organization’s connection with existing policy holders. But it’s cumbersome when you have multiple core systems and at some point, carriers will hit the limits of what their old systems can provide in terms of future capabilities and value.

On the other hand, taking a greenfield approach can enable a carrier to really build out the best, most fully realized engagement model.

— Sanjay Kaniyar, Partner, McKinsey & Company

Integrating with older systems or replacing them with modern platforms may take a lot of effort and investment. But if we have defined our vision for customer engagement and the technologies that will be required to achieve it, then carriers may find that investments made today will set the stage for customer success for years to come.

To learn more about how to improve customer experience and engagement in the insurance industry, watch the Equisoft Accelerate Series webcast: Driving Digital Client Engagement Through The Entire Insurance Value Chain.