—CIO Research Participant

Understanding the true picture of how LATAM insurers are using their data #

Insurers around the world have recognized the strategic importance of the vast volumes data that continually streams into their databases. They seek to convert the potential of that data into actual intelligence that can dramatically improve efficiencies, accelerate and enhance product development and guide them in crafting digital experiences that exceed the expectations of today’s consumer.

But capitalizing on these data opportunities poses challenges for all companies. The rich promises of data-driven growth that we hear at every conference and in every webinar are difficult to fulfill.

That’s why Equisoft partnered with Celent to conduct research in the LATAM market (as part of a global research initiative) to understand what insurers in the region are doing to create value with their data, what challenges they face and what priorities and plan they have for the near future.

—Equisoft & Celent Research: Getting Value From Data

Top ways LATAM CIOs are getting value from their data today in IT and operations #

How data increases efficiency throughout the policy lifecycle #

While the research report revealed many priorities for CIOs, the top area of value creation is in enhancing every step of the policy lifecycle, from new business processing, to customer management and through to claims.

The impact of data on each step in the policy journey #

When technology is integrated across the steps in the policy lifecycle data flows freely from end-to-end.

Purpose-built advisor CRMs enable advisors to easily mine the data in their books of business to most effectively segment their client base. This segmentation creates more granular marketing possible and drives different levels of proactive service for highly value clients. At this stage data is the fuel that drives successful prospecting, but also enables cross-selling and increases depth of relationship.

In an integrated tech stack, data flows from those advisor-specific CRMs to populate needs analysis tools that quickly and automatically generate plans that are more likely to be compelling to the consumer.

The sales process can be closed out using digital front-end solutions like quote and illustration software, and eApplications that use the data to generate product recommendations and electronic policy applications. Unlike traditional sales processes, this digitalized version requires fewer meetings, no redundant data entry and accelerates the entire experience.

Beyond policy issuance the automated flow of data through agent and client portals creates great customer experiences because it makes service activities quicker and more effective. This is accomplished modern policy administration systems and APIs to permit the flow of data from underwriting to claims.

Finally, claim submission is also accelerated through the easy ingestion of data and the automated analysis of that information which reduces fraud, speed payments and decreases the carrier resources required for investigation.

Enhanced customer experience is driven by data #

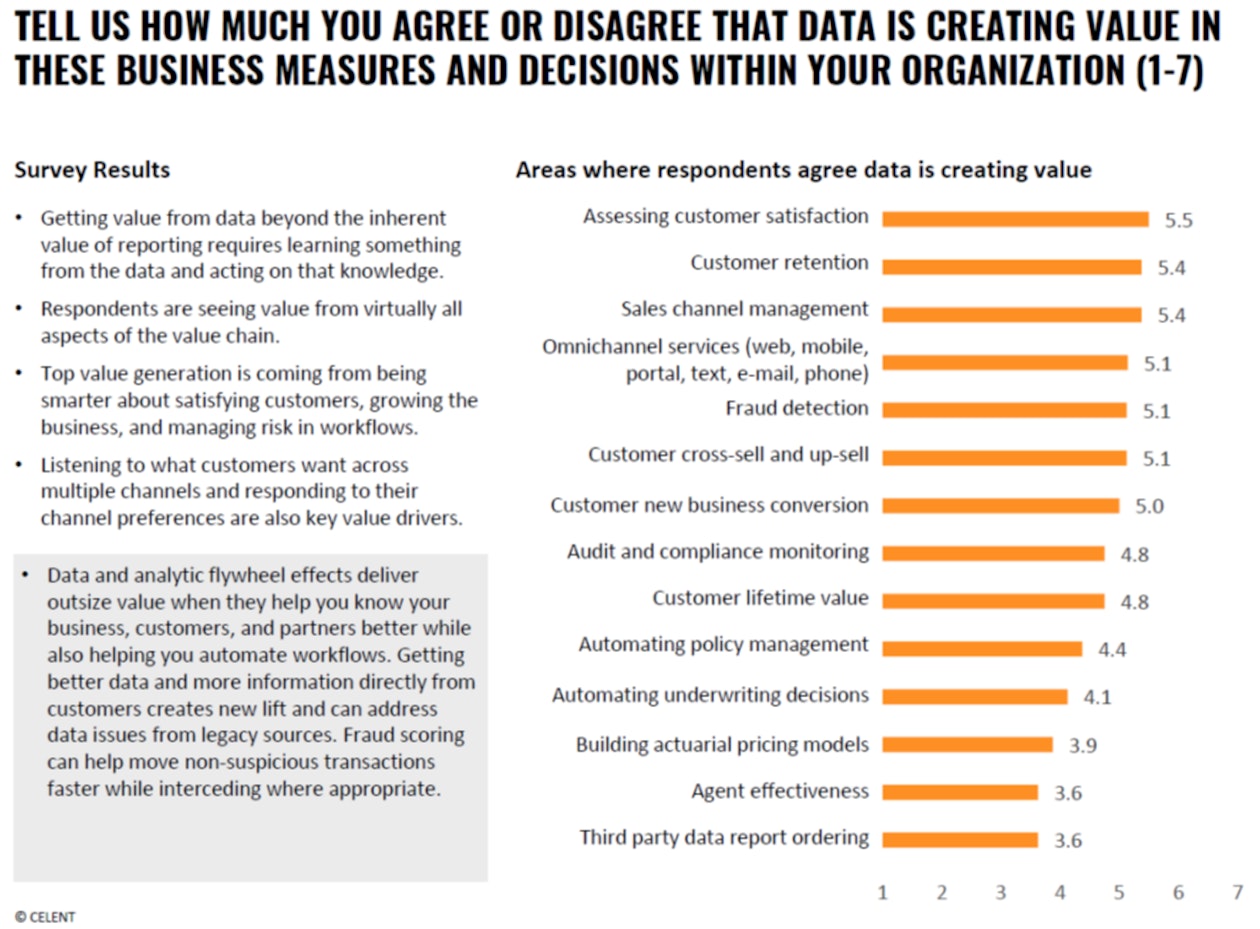

In the Getting Value from Your Data research, when CIOs were asked about how data enhances decision making within their organization, the strongest benefits were seen in assessing customer satisfaction and enhancing customer retention‒two sides of the customer experience coin.

3 ways data improves insurance customer experience #

1. Know and empathize with your client to increase retention #

Leveraging your data is critical to understanding your customers. Deep interpretation of data using analytics and AI processes can take you from a rudimentary knowledge of a customer’s demographics to a deeper and more useful empathy for them. It can transform marketing, sales, service and relationship management if you are able to go from building great customer experiences to creating powerful customer engagement.

But it all starts with data. And LATAM CIOs are now using it to provide wisdom to the business units about customer preferences, their goals and where they are in their life cycle. Data makes it possible to build increasingly granular customer journeys that are very targeted, and, because of that, customers can be matched to more bespoke products, marketed to in the most effective way at the right time‒in whatever channel the customer is most comfortable.

LATAM insurers are using their data right now to increase customer satisfaction and build lifetime value and retention.

2. Data makes insurance policy approvals quicker and less painful #

The customer’s experience of the approval process is enhanced when that workflow is streamlined. Especially since the onset of the pandemic, insurers have been looking for ways to better stratify risk and, to whatever degree possible, automate underwriting to create a faster more seamless application process. These enhancements are made possible, not just by accessing and leveraging the organization’s own data, but by engaging third party data sources. Client data is melded with information from a variety of public and private inputs, such as census reports, prescription histories and medical records.

Applications that used to weeks to underwrite can now be decided on in days. In many cases, the manual interactions, like medical exams or phone interviews, that slow the application process and ruin customer experience are no longer necessary.

3. Data enables carriers to measure customer satisfaction more accurately than ever before #

Traditional measures of customer satisfaction like NPS are still useful. But now we have access to so much more potential data that carriers are using to accurately judge the effectiveness of their customer experience and engagement efforts.

Chatbots, robo-advisors, online company and product ratings, social media questions and surveys are generating a tide of data that reveals customer attitudes towards the companies they interact with.

And beyond those new developments are even more game-changing marriages of technology and process, such as health and Wellness programs like Vitality which enable carriers to interact in meaningful ways with participants on a daily basis. They, through IoT, provide a flood of information on customer behavior and provide insights about how engaged they are.

Wrap up #

While the promised data-driven future of insurance may not have been fully realized yet, insurers across the LATAM region are getting tangible value from their data. Already they are using it to improve pricing and risk stratification, streamline operations, and accelerate policy on-boarding. Perhaps most importantly, client data from many sources is being leveraged to enhance customer experiences and push the industry forward into new digital capabilities that consumers now demand.

To find out about more ways LATAM CIOs are obtaining value from their data download the full research report.